The 50/30/20 Rule vs. The Anti-Budget

Is the 50/30/20 rule outdated? Compare it with the 'Anti-Budget' method to find the simplest way to manage your cash flow.

Is the 50/30/20 rule outdated? Compare it with the 'Anti-Budget' method to find the simplest way to manage your cash flow.

Einstein called it the eighth wonder of the world. See how compound interest can turn small habits into massive wealth.

Not all debt is created equal. Learn the crucial difference between debt that destroys wealth and debt that builds it.

You don't need to be a stock picker to get rich. Here is the 3-fund strategy that outperforms the pros.

In an uncertain economy, the old rules might leave you exposed. Calculate your true 'sleep well at night' number.

As the dollar loses value, where should you put your money? We analyze Gold, Real Estate, and Stocks as hedges.

How to keep your cool when the market is red. Ancient Stoic philosophy applied to modern portfolio management.

Stop leaving money on the table. Copy-paste these email templates to negotiate your next raise with confidence.

Want to eliminate your biggest expense? Learn how house hacking works and how to buy your first multi-family property.

Does cutting out coffee really make you a millionaire? We run the numbers on 'small wins' vs. 'big wins'.

A sober, hype-free look at Bitcoin's role in a modern diversified portfolio.

The FIRE movement isn't just for tech bros. Here is a realistic roadmap to financial independence.

Protect your family and assets with this simple estate planning checklist. If you have kids or a house, you need this.

Why having available cash gives you the power to say 'no'. It's not about being rude; it's about being free.

Willpower is a limited resource. Build a financial machine that saves and invests for you while you sleep.

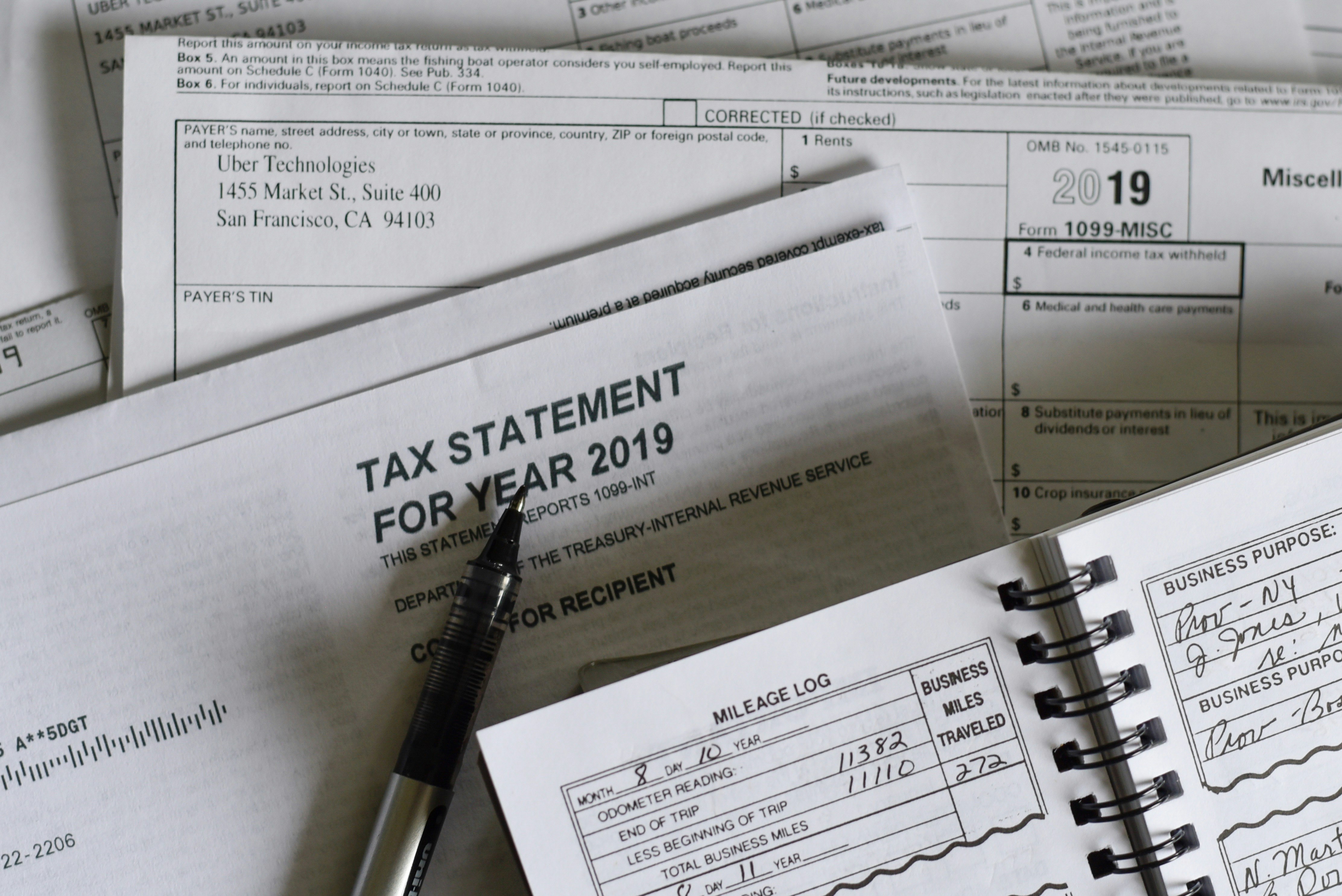

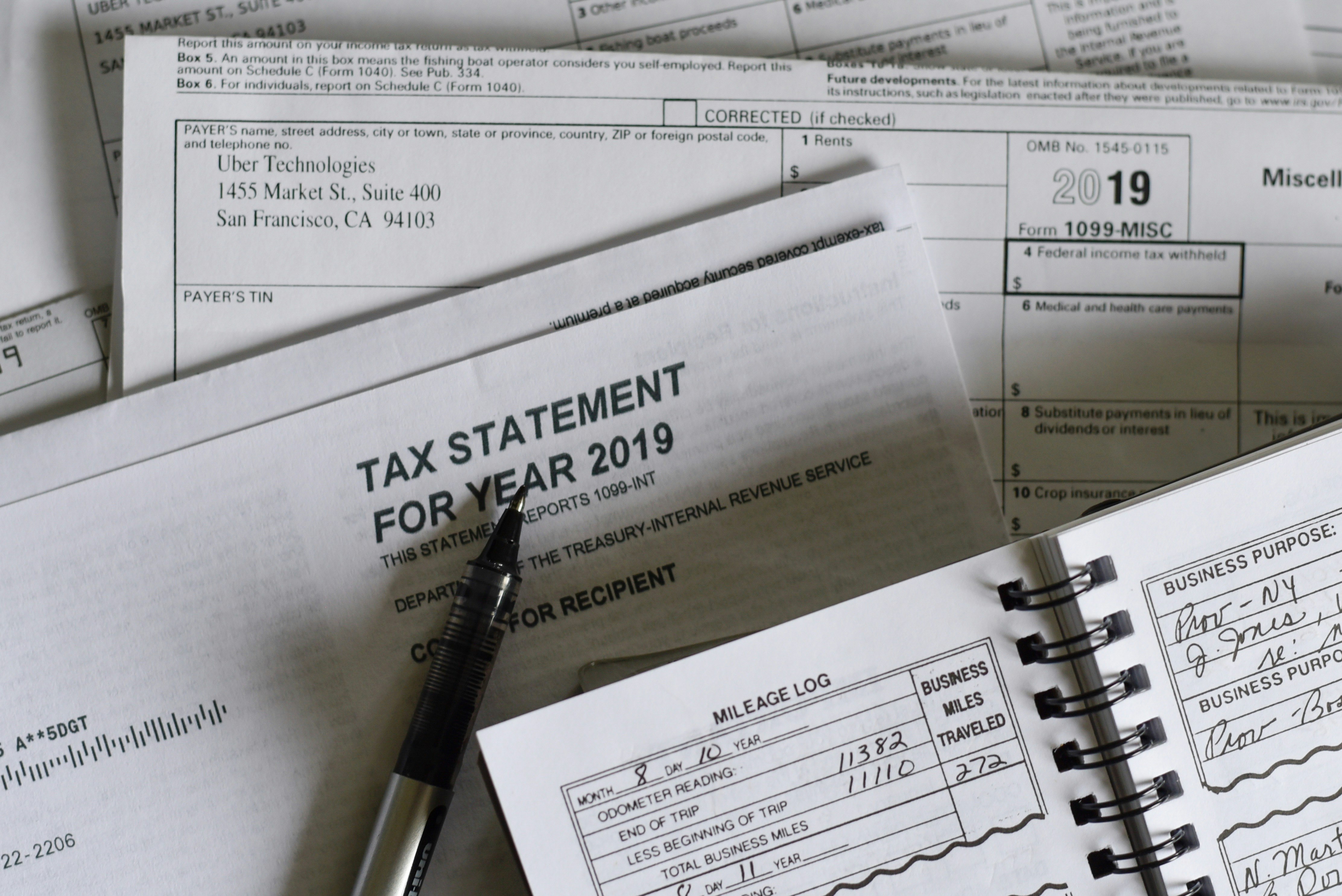

Basic tax strategies to legally reduce your liability. It's not what you make, it's what you keep.

Forget dropshipping and surveys. Here are scalable side hustles that actually pay.

Every day you wait to start investing costs you exponential returns. We quantify exactly how much procrastination costs.

Strategies to ensure your wealth supports your children and grandchildren without spoiling them.

Forget the 401k for a second. The Health Savings Account (HSA) offers a triple tax advantage that no other account can match.

You have auto and home insurance, but are you covered if you get sued for $2 million? Here is why the rich love Umbrella policies.

Car salesmen love leases. Financial experts usually hate them. We break down the math to see if leasing ever makes sense.

Why saving every penny for a future you might not see is a mistake. A look at Bill Perkins' controversial philosophy.

Want to own skyscrapers and malls without unplugging toilets at 2 AM? Real Estate Investment Trusts are the answer.

You don't need a revolutionary startup idea. You just need to solve a boring problem for someone with money.

How to leverage credit card points and airline miles to see the world for pennies on the dollar.

Financial stress is a leading cause of divorce. Here is a framework for merging (or not merging) finances with your partner.

Insurance agents love selling Whole Life. We explain why you should probably buy Term and invest the difference.

Investing in boring companies that have raised dividends for 25+ consecutive years. Safe, steady, and compounding.

Don't just hold your crypto. Stake it to earn 4-10% APY. We explain the risks and rewards of Proof-of-Stake.

The USDA says a child costs $300k to raise. Here's how to budget for the tiny humans without going broke.

Run your life like a business. Learn to track Assets vs. Liabilities to find your true Net Worth.

ESG (Environmental, Social, Governance) funds are booming. But do they sacrifice returns for morality?

The Joneses are probably broke. Why social comparison is the thief of joy and the enemy of wealth.

Do you need a financial planner? Or can an algorithm do it better and cheaper?

How to invest in startups before they go public. High risk, massive potential reward.

College prices are soaring. A 529 Plan is the tax-privileged way to prepare for the tuition bill.

Put bonds in your IRA and stocks in your taxable account? We unpack the strategy of tax-efficient placement.

Trading apps throw confetti when you buy a stock. Is this democratizing finance or creating gambling addicts?

Join 10,000+ wealth builders receiving one actionable financial law every week. No spam.